KfW projekti u Srbiji

European Fund for Southeast Europe (EFSE)

Project: World’s largest micro-finance fund since 2005

EFSE is one of the world’s largest microfinance fund with around EUR 1 billion capital commitments. The fund is the leading provider of long-term funding to selected partner lending institutions in Southeast Europe and Turkey as well as in the Eastern Neighborhood Region – the so called – to serve the financing needs of micro and small enterprises (MSE) and low-income households.

Commissioned by: BMZ, EU, KfW, EBRD, EIB, IFC, FMO, OeEB, DANIDA, SDC, ADA, SMBCS; Government of the Republic of Albania, and many private investors Fund Management: Hauck & Aufhauser Fund Services (Fund Manager), Finance in Motion (Fund Advisor)

Beneficiary Countries: 16, including: Albania, Armenia, Azerbaijan, Bosnia-Herzegovina, Bulgaria, Georgia, Kosovo, Croatia, North Macedonia, Moldova, Montenegro, Serbia, Romania, Turkey, Ukraine and Belarus

Approach / Mission

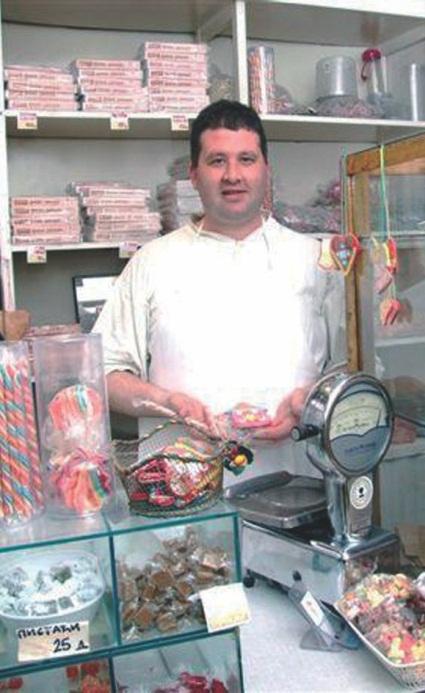

EFSE’s mission is to foster economic development and prosperity in Southeast Europe and the EU Eastern Neighborhood Region by supporting the success of MSEs and improving living conditions for households. In doing so, the Fund is actively contributing to the Sustainable Development Goals (SDGs). Tracking its contribution to SDG targets is an integral part of the EFSE’s comprehensive impact management framework. Towards its positive impact goal, EFSE has supported more than 1.9 million MSE jobs refinanced through local financial institutions (around 90,000 in 2021), including self-employment and employment in micro and small businesses. Working towards its positive impact goal, EFSE has supported more than 1.9 million jobs in MSEs receiving financing through a PLI (around 90,000 in 2021), covering self-employment and employment in micro and small businesses. In addition, 47,000 women-owned enterprises were founded through MSEs finance, which proves that EFSE contributes to sustaining and growing business income among marginalized entrepreneurs, such as women and rural populations.

By improving the provision of MSMEs with various adequate financial services, the EFSE actively contributes to the private sector development as well as secures and creates employment and income opportunities. By enabling private households to have access to loans for modernization measures the project aims at improving standard of living for the people in its target region.

EFSE-Commitment in Serbia (as of 31/12/2022)

Share of Serbia of total EFSE portfolio: 13%

Volume of loans to end borrowers (since its inception in 2005): EUR 1.4 billion

Number of loans to end borrowers (since its inception in 2005): 123,318

Average loan amount: EUR 14,867

In addition, the EFSE Development Facility has been organising in Serbia 78 different steering measures, advanced trainings or training events for customers and partner institutions since its inception in Serbia with a promotional volume of more than EUR 3.2 million.

The project is in line with the individual BMZ country strategies. Within the framework of the 2030 Agenda, the project supports the SDG sustainable development goals. In addition to ending poverty, these include sustainable economic growth and decent work for all, sustainable industrialization, reducing inequality and strengthening global partnership.